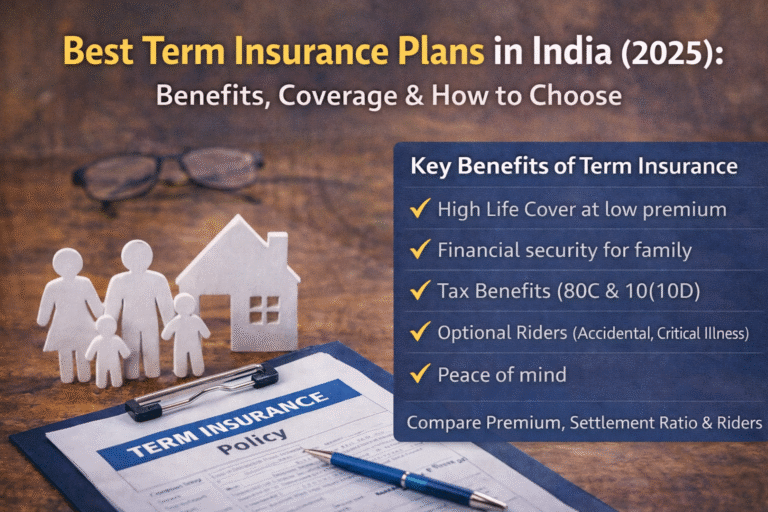

Life is unpredictable, and financial protection for your family is essential. Term Insurance is one of the most affordable and effective ways to secure your family’s future in case of an unfortunate event.

In this article, you’ll learn:

- What Term Insurance is

- Key benefits and coverage

- How much cover you should choose

- How to buy term insurance online in 2025

What is Term Insurance?

Term Insurance is a pure life insurance plan that provides a high life cover at a low premium. If the policyholder passes away during the policy term, the sum assured is paid to the nominee.

👉 There is no maturity benefit, which makes it affordable and simple.

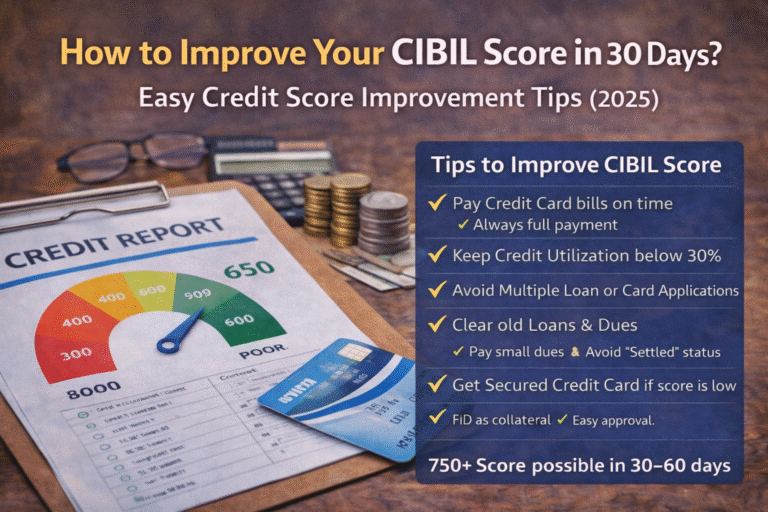

Key Benefits of Term Insurance

✔ High life cover at low premium

✔ Financial security for family

✔ Tax benefits under Section 80C & 10(10D)

✔ Optional riders (Accidental, Critical Illness)

✔ Peace of mind

How Much Term Insurance Cover Do You Need?

Experts recommend 10–15 times of your annual income.

| Annual Income | Recommended Cover |

|---|---|

| ₹5 Lakh | ₹50–75 Lakh |

| ₹10 Lakh | ₹1–1.5 Crore |

| ₹15 Lakh | ₹1.5–2 Crore |

Best Term Insurance Plans in India (2025)

- LIC Tech Term Plan

- HDFC Life Click 2 Protect

- ICICI Prudential iProtect Smart

- Max Life Smart Secure Plus

- Tata AIA Sampoorna Raksha

👉 Always compare premium, claim settlement ratio, and riders.

How to Buy Term Insurance Online

- Visit the insurer’s official website

- Choose Term Insurance plan

- Enter age, income, and lifestyle details

- Select cover amount & policy term

- Add riders if needed

- Pay premium and download policy

Things to Check Before Buying Term Insurance

⚠ Claim Settlement Ratio

⚠ Policy exclusions

⚠ Premium payment term

⚠ Medical requirements

⚠ Insurer reputation

FAQs – Term Insurance

Q1. Is term insurance mandatory?

No, but it is highly recommended.

Q2. Can I buy term insurance after 40?

Yes, but premium will be higher.

Q3. Is online term insurance safe?

Yes, if purchased from official insurer websites.

Disclaimer

This article is for general information purposes only. Please read the official policy document before purchasing any insurance plan.